Prefixes for strategies

To distinguish strategies with the same name on the chart and in the list of strategies, you can set a prefix for each launched strategy.

For example, you have launched squeezes on one asset and to avoid confusing limits during trading, you can set a 4-digit prefix for each strategy at launch. This prefix will be displayed in the Limit field and in the list of strategies (if the Strategy ID column is enabled).

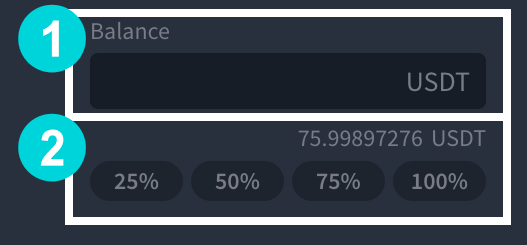

The prefixes are located in the strategy window, to the left of the name field (1) and in the strategy block (2).

Thanks to this option, you can quickly distinguish strategies on the chart when trading intraday and do not confuse positional entries from intraday ones.

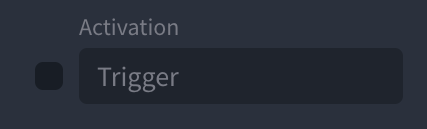

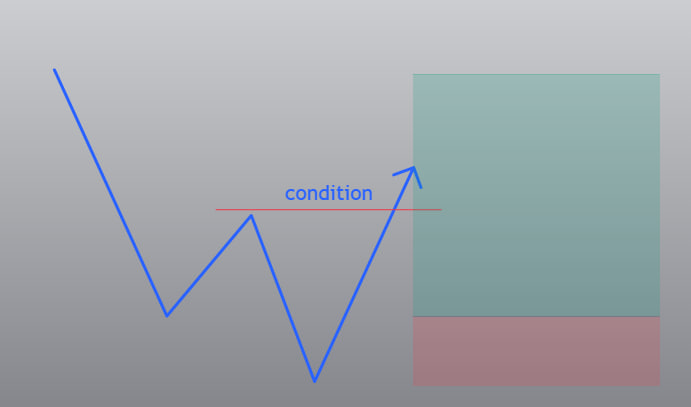

7. For Intraday and Fibo strategies, a “Condition” trigger has been added, which keeps the strategy “on standby” until the price meets the specified condition. While the condition is false — no orders are placed and the strategy does not activate via the start trigger.

How it works

Enable the trigger and set a condition (e.g., price above N / higher high, etc.).

At the first touch of the level, the condition is considered met — the strategy wakes up via the trigger and starts operating according to its logic.

Examples

Fibo: you want to trade from 0.618 only after a higher high. Enable the trigger → set “price above X”. As soon as the price breaks X — the strategy is ready to wake up via the start trigger and will place the calculated limit orders.

Intraday: launch only after a structure break. While there is no break — the strategy sleeps. When the break occurs — it is ready to activate via the trigger and continues working. (see example)

- It reserves the allocated amount of the deposit.

- It places buy orders.

- In the "Strategies list" block the on/off toggle is green

.

- It doesn't reserve the allocated amount of the deposit.

- It doesn't place buy orders.

- In the "Strategies list" block the on/off toggle is yellow

.

- It doesn't reserve the allocated amount of the deposit.

- It doesn't place buy orders.

- In the "Strategies list" block the on/off toggle is red

.

- Can be restarted by the user. Before activation, analyze the relevance of the settings to the market situation.

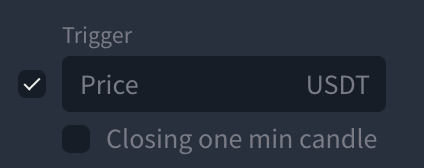

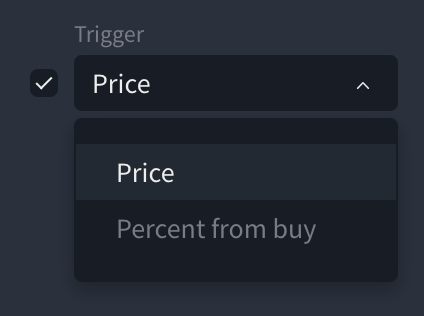

If the ‘By candle close’ checkbox is ticked, the stoploss trigger will be triggered only if the candle close on the selected timeframe is below the level specified in the ‘Price’ field.

The ‘By candlestick close’ checkbox and the choice of order type for the stop are initially hidden. They appear when entering a value in the trigger field or when activating the trigger by ticking the checkbox next to the ‘Price’ field.

- In the configuration window, go to the "Stop Loss+" tab.

- Click "Add stop loss".

- Use the tool to set the stop trigger level (horizontal or dynamic line) on the chart.

- Click on the checkmark in the toolbar.

- When the price touches the added stop-loss line, the strategy cancels all take orders and sales all its positions (market sale).

- After activation and execution of the additional stop-loss, the ID and FIBO strategies will finish their work. And cyclic strategies CHANNEL and SQUEEZE will continue to work.

Breakeven Stop Loss (SLBE)

In addition to the stop loss+ represented by a line, strategies can be set with a stop loss at the breakeven level of the strategy itself.

The breakeven level of the strategy serves as a trigger for activating the Stop Loss and is dynamically adjusted based on the breakeven level of the active strategy. The same settings as the regular SL+ order are used for executing SLBE.

Features:

Does not cancel the main Stop Loss.

The option is available only after the breakeven level of the strategy appears (when there is a position); otherwise, the option is disabled.

Moves together with the breakeven level of the strategy.

Can be added through:

The "three dots" on the chart;

In the strategy configuration - SL+ tab;

Through the list of strategies (breakeven column)

- The "Shield" icon has two colors and states:

- Gray - SLBE is inactive;

- Orange - SLBE is active.

- The "Shield" icon has two colors and states:

To disable the breakeven stop loss, click on the "shield" icon in the list of strategies or use the corresponding button in the strategy configuration, SL+ tab, or in the "three dots" menu on the chart.

Note:

When adding SLBE when PNL is negative, a warning dialogue box will pop up:

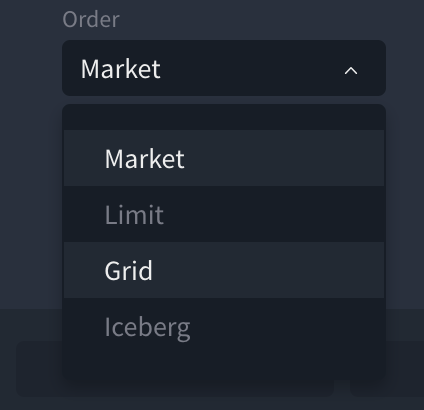

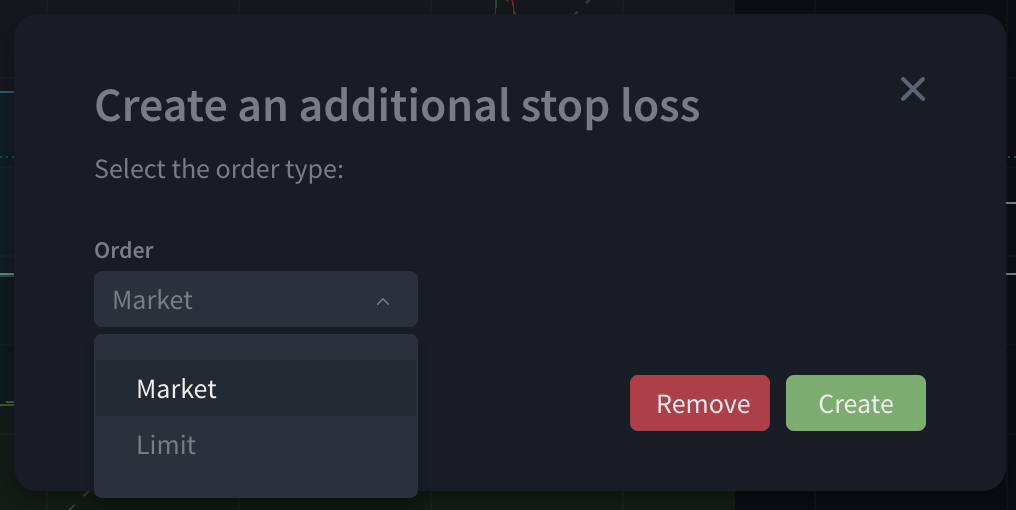

Where two options will be available: ‘Market’ and “Breakeven”.

If ‘Market’ is selected, the position will be sold at the market price.

If you select ‘Breakeven’, the strategy will sell the entire position when the price reaches the breakeven level.

‘Liquidation’ only for FIBO & CHANNEL strategies.

For strategies with averaging in the isolated margin mode, there is an option to calculate position liquidation.

The option has two states: without yellow highlighting; with yellow highlighting.

- When the liquidation field is not illuminated, it means that the liquidation level is outside the FIBO or CHANNEL grid and gives a preliminary warning that the set-up is ‘safe’.

- When the elimination field is lit yellow - it means that the elimination level is in the planned grid area (between levels) and it preliminarily informs that the set-up is ‘not safe’.

The figure shows a grid where the liquidation level is between buy level 1 and buy level 2.

‘Green Channels’ - dynamic order management (Deposit Optimisation).

For Channel and Fibo strategies the ‘Deposit Optimisation’ option has been added - this option allows to use not the entire deposit for all levels at once, but to reserve it as needed, without stopping the strategy if the balance is insufficient for the next levels.

Operation modes: Manual and Auto (by default the option is switched off).

In Manual mode - the user chooses how many levels should be activated at once.

With Auto - the platform calculates the required number of levels and will place the next ones as orders are executed.

The principle of operation on the example of Fibo:

When activating the option of deposit optimisation on ‘auto’, the platform will calculate the number of levels and place the next ones. In case of execution of the first level, the second level will be activated, and so on up to the last one.

The platform will automatically rebalance it for orders by intervals:

1st in a minute;

2nd in 5 minutes;

3rd after 60 minutes;

The 4th will make 4 attempts every 60 minutes.

The strategy will make a total of 7 attempts, after which the automatic request is switched off. At the same time, it is still possible to manually re-request the balance for unplaced orders through the strategy settings window

In case of manual balance request, a dialogue box will appear:

‘Select the channels for which the balance should be requested’

All channels - this option includes all non-activated levels/orders, both above and below the current price. If there are unactivated channels above the current price, the order/level will be executed at the current price.

Below price - includes only levels below the current price.

Tab "Other"

The setting determines the "lifetime" for the strategy. The default setting is "7 days". Applicable only to strategies launched with an activation trigger. If the strategy is not activated within the user-selected time (from the moment of launch or the last deactivation), it stops.

When creating a strategy, the "lifetime" parameter can be adjusted to another value that corresponds to your license. After launching, this parameter will be fixed for the specific type of strategy/template. Additionally, long and short strategies will have individual lifetime.The maximum available duration for the "Standard" subscription is 1 month, and for the "Pro" subscription, it is 6 months.

1. The settings of an active strategy are changeable:

- In the configuration window from the "Strategies list".

- In the toolbar by clicking on the robot icon.

- In the edit strategy menu by clicking the right mouse button.

- In the new toolbar after a strategy creation .

- In the menu of this tool by clicking the right mouse button.

- In the "Strategies list" block

.

- Sell to market

- Cancel buy orders

- Cancel all orders

- Leave orders

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article